EURUSD 4 HR Elliott Wave Count

I don't actually have any wave labels on this chart because I wanted to look at this from a price action side right now.

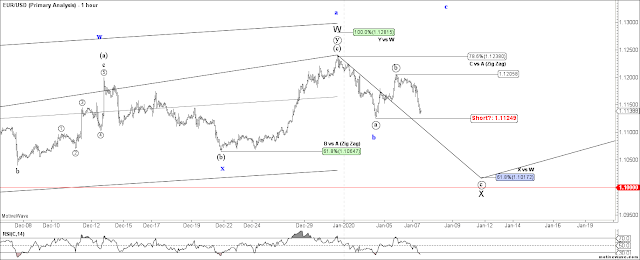

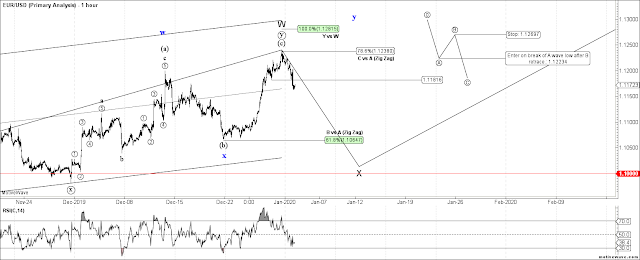

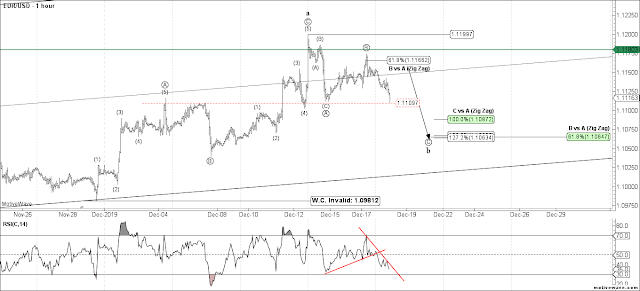

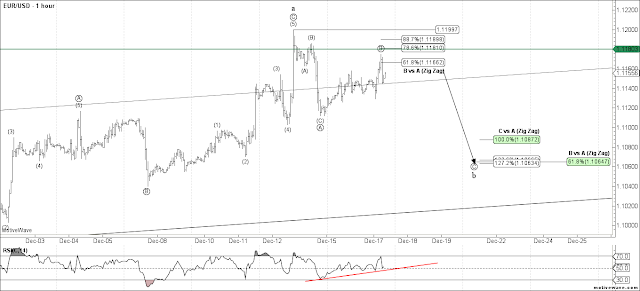

In the chart below, price made a lower low in Oct of 1.0872 and bounced from there running up to 1.11795. These high of 1.11795 broke above the last two corrective swing highs (Lower Highs) showing strength and indicating more up is possible.

From the 1.11795 high price pulled back to the 1.09812 low before bouncing again. It bounced from the 1.09812 low up to 1.11997. This price action started the Higher High and Higher Low sequence with 1.09812 now becoming an important low if price is going to continue higher.

Price then pulled back to the 1.10663 low and moved higher again up to 1.12404 creating another Higher High and Higher Low at 1.10663. Now, the 1.10663 low is what I consider an minute Swing Low with the 1.09812 a Minor Swing Low and 1.0872 a major Swing Low.

Obviously the Minute swing low is important in the Higher High/Higher Low Price Action Game but not as important as the Minor or Major.

Bottom line is that is the EURUSD is going to continue to move higher in a Higher High/Higher Low sequence then the 1.10663 low SHOULD hold as price moves higher back above 1.12404.

The other important thing to keep in mind is that corrections happen in 3-7 and 11 swings and I am showing that we only have 6 swings with this recent pullback. A 7th swing would need to break above 1.12404 to complete the corrective pattern.

P.S. - When I count swings I count the Higher Highs/Higher Low only. Opposite in the down trend.

|

| EURUSD 4 HR Price Action Chart |