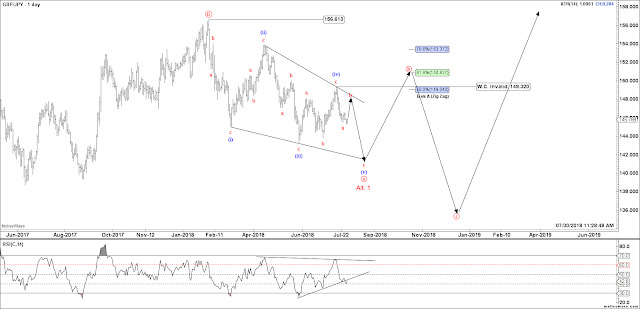

GBPJPY Daily Elliott Wave Count

GBPJPY Daily Elliott Wave Count updated on 08/10/18

The most recent price action from the 149.32 highs is forming a

5 Wave Impulse that is currently in wave iii with targets of 140.60 at the 161.8% extension followed by 139.00 at the 200% extension.

I am pretty confident we will hit the 140.60 and with the strength of this wave

3, I think we could hit the 139.00 as well before the GBPJPY starts the wave

4 consolidation.

GBPJPY Elliott Wave Count Since Oct. 2016

Since the Oct. 2016 lows of 124.69 the GBPJPY made an ABC correction up to 156.13 for the

blue circle a wave that ended in Jan of 2018. The

(c) leg of this move played out in a nice

Elliott Wave End Diagonal with 5 waves up forming a

Rising Wedge shape with the wave

i and

iv overlap.

From the 156.61 highs the price action created a nice 3-3-5 flat structure for the

(w) followed by a zig - zag

(x) wave up to 149.32.

With the

(w) and

(x) wave complete, price action looks to be playing out a 5-3-5 Zig-Zag for the

(y) wave of

blue circle b.

Please visit the following links for the Weekly, 4 Hour and Hourly GBPJPY Elliott Wave Counts.

|

| GBPJPY Daily Elliott Wave Count |

GBPJPY Daily Elliott Wave Count updated on 07/30/18

From the highs of 156.13 the GBPJPY has fallen in overlapping three wave moves. This leads me to believe that the pair is creating an Elliott Wave Leading Diagonal for

a or

1 down with wave

(iv) complete at 149.32 and wave

(v) in the works.

The leg down from 149.32 I believe is complete and we are in an Elliott Wave Expanded Flat. But, as I mention in the U.S. Open Hourly update I would stay bearish until the 146.543 swing high was taken out. If we do get a deeper b wave correction I would be looking to short against the 149.32 wave

(iv) high with a target of 141.00.